Recently came across this very interesting video on youtube by Tom Ferry, which breaks down a very interesting and accurate in our opinion of how to manage your money.

The Treasury is finalising plans to overhaul tax rules which allow self-employed people to avoid paying national insurance contributions.

The move will be targeted at people who set themselves up as private companies to take on work.

announcements that may be in this month’s Budget.

The Treasury believes a third of people claiming self-employed status as a “personal service company” are actually full employees and should pay more tax.

It says without reform, high levels of non-compliance with tax rules could cost HM Revenue and Customs, which collects taxes, £1.2bn a year by 2023.

It is now looking at demanding that firms which use personal service company contractors take legal responsibility for ensuring “off-payroll” contractors stick to the tax rules known as IR35.

A similar move in the public sector on “synthetic” self-employed has raised £410m extra in taxes since 2016, HMRC estimates suggest.

Full employees pay higher levels of national insurance compared with the self-employed.

Philip Hammond is under pressure to raise taxes at the Budget following the Prime Minister’s pledge of £20bn worth of extra spending on the NHS by 2023.

Personal income tax allowances could be frozen, despite a Tory pledge at the 2017 election that they would rise to £12,500 for lower rate taxpayers and £50,000 for higher rate taxpayers by 2020.

Freezing them could raise up to £2bn a year.

Reform of the IR35 rules would not raise as much, but might be less politically controversial.

Britain’s high streets will be dominated by charity shops and betting shops unless business rates are overhauled, a senior Tory councillor has warned.

With just under two weeks to go until the Budget, Philip Hammond was urged to create a ‘level playing field’ for regular shops as they face an onslaught from online giants.

The leader of Westminster City Council called for a 1 per cent turnover tax on tech giants such as Amazon to alleviate the pain.

Hammond told the Tory party conference last month he might introduce a digital services tax on web giants such as Amazon, Facebook and Google.

The Mail has called for a reform of business rates as part of our Save Our High Streets campaign amid a crisis gripping the sector.

Around 50,000 retail jobs have already been lost this year, and about 61,000 stores have shut in the past five years.

Major retailers such as Poundworld, Toys R Us and Maplin have gone bust while House of Fraser was saved from collapse by Sports Direct.

Councillor Nickie Aiken, leader of Westminster City Council, said: ‘I absolutely support the Mail’s campaign. Westminster City Council has already called for a 1 per cent turnover tax on tech titans.

‘I would ask the Treasury: do we want to continue the decline so that the only things left on the High Street are charity shops and betting shops?’

Business rates are based on the estimated rental value of a retailer’s property. Andrew Goodacre, chief executive of the British Independent Retailers Association, said: ‘It becomes a real challenge to afford, because it doesn’t matter how well or how badly you’re doing, the cost is not going down.’

Edward Woodall, head of policy at the Association of Convenience Stores, said the tax discourages investment.

If a shopkeeper refurbishes their store, or installs new equipment, it makes the property more valuable, so rates go up. He said: ‘The system doesn’t really incentivise investment.’

Article written for http://www.cloudbookkeeper.co.uk/ by IAB

Bookkeeping myths

Regardless of where you stand within the business world, bookkeeping can prove to be a difficult task. Involving the likes of keeping a track of finances, enduring that paperwork is organised, and –ultimately – many more tasks which a busy worker may find difficult to perform.

It just so happens that these performing these tasks are vital to having a business which runs properly. One way to ensure that all bookkeeping talks are completed with little detrimental effect to you and your business is to hire a bookkeeper – be it from a firm or an independent individual.

Oddly enough, there are several misconceptions and myths that surround hiring a bookkeeper for your business – luckily, we’re here to tackle them.

Only big businesses need help from a bookkeeper

Many imagine that a bookkeeper is something that only large, prestigious businesses and corporations need. This couldn’t be further from the truth, we’ll assure you. When you first start your business, you may find yourself feeling a tad overwhelmed at the wealth of tasks that need to be performed – anything from finding office space, to sorting out any legal affairs. Hiring a bookkeeper during this time can help to lighten the load a little – even more so if you aren’t confident in your math or organisational abilities.

Never be afraid or feel ashamed to contact a professional bookkeeper, regardless of your businesses size – be it a still- blooming start up to a sizeable success story.

My business doesn’t make enough money to hire a bookkeeper

You may have to shop around a tad to find a professional bookkeeper that allows you to live and work comfortably within your personal budget, but as a whole, hiring a bookkeeper can help you to save money in the long run.

Think of it like this; all of the time you may spend trying to organise paper work, doing sums, and trying to keep everything together could be better spend growing your business in a wealth of ways. Hire a bookkeeper, and you’ll find that all of this time is magically freed up – meaning you’ll most likely more of a profit in the process!

Bookkeeping is just about maths

This is one of the most common misconceptions about bookkeeping – besides that it’s all about collecting books, too.

In reality, bookkeepers are involved more in the numerical side of your financial issues. As well, they can also assist you with communication, which is ultimately how they help you to save time and money in the long run.

For example, you may have difficulty expressing what you want from an insurance package from your business, or you may be struggling with a difficult aspect of the maths behind your money. Hire

the correct bookkeeper, and you’ll have everything explained to you in a way that you understand, as well as being a lot more organised.

Anyone can do bookkeeping

There’s tons of knowledge needed to be a bookkeeper, and not knowledge that can be gained overnight or after a quick course. Bookkeepers can go through years of training, working, and assessments before they can become qualified. This ensures that you’ll only ever hire a bookkeeper that knows everything needed to correctly understand transactions, collating, and analysing accounts without any error.

‘I don’t need a bookkeeper, I’ve been okay so far!’

It may have been smooth sailing for you and your business so far, but one just remember that the business world is one that is constantly changing, which makes it likely that your business will have to adapt accordingly. It may not necessarily be in a negative way, it may be that you have to learn how to use a popular new social media site, or that you decide to upgrade to a bigger office space – whatever it may be, plenty of work may be required!

The point is; no business stays the same forever. Hiring a bookkeeper to take care of your accounts and paperwork can be all the help in the world when you have a growing business to take care of. As well, a bookkeeper can offer you expert advice in regards to what the best path for your business to take best would be.

Hopefully, you can now see that hiring a bookkeeper is one of the best – and easiest – ways to ensure that your business doesn’t begin to fall behind. Get hiring, and you can then begin to focus on the most important thing of all – running your business.

For further if formation about bookkeeping, hiring a bookkeeper, and anything else regarding bookkeeping, don’t hesitate to contact the International Association of Bookkeepers (IAB).

The chancellor has presented his budget to parliament, we’ve outlined some of the highlights below.

Lifetime ISA: a new £4,000 ISA that you can use to save for retirement or to buy your first home

From April 2017, any adult under 40 will be able to open a new Lifetime ISA. Up to £4,000 can be saved each year and savers will receive a 25% bonus from the government on this money.

Money put into this account can be saved until you are over 60 and used as retirement income, or you can withdraw it to help buy your first home.

The total amount you can save each year into all ISAs will also be increased from £15,240 to £20,000 from April 2017.

Personal Allowance will increase to £11,500, and the higher rate threshold will rise to £45,000 in April 2017

The Personal Allowance is the amount of income you can earn before you start paying Income Tax. This is currently £10,600 – it will already rise to £11,000 in 2016, and will now increase further to £11,500 in April 2017.

The point at which you pay the higher rate of Income Tax will increase from £42,385 to £43,000 in 2016 and to £45,000 in April 2017

tax allowances for money earned from the sharing economy

From April 2017, there will be two new tax-free £1,000 allowances – one for selling goods or providing services, and one income from property you own.

People who make up to £1,000 from occasional jobs – such as sharing power tools, providing a lift share or selling goods they have made – will no longer need to pay tax on that income.

In the same way, the first £1,000 of income from property – such as renting a driveway or loft storage – will be tax free.

Making sure large companies can’t artificially shift profits out of the UK

Some large companies use excessive interest payments to reduce the tax they pay on their profits in the UK. Relief on interest payments will now be capped at 30% of UK earnings, with exceptions for groups with legitimately high interest payments.

Over the next 5 years, the government will raise nearly £8 billion from large companies and multinationals through changes to the rules on interest and other measures, including:

- introducing rules to prevent multinational companies avoid paying tax in any of the countries they do business in, a technique called hybrid mismatches

- taxing outbound royalty payments better – these are fees for using intellectual property like patents and copyrights – meaning multinationals pay more tax in the UK

- making sure offshore property developers are taxed on their UK profits

Tax support worth £1 billion for the oil and gas industry

This includes effectively abolishing Petroleum Revenue Tax (a tax on profits from oil fields approved before 1993) and dramatically reducing the supplementary charge on oil and gas extraction.

Cutting business rates for all rate payers

From April 2017, small businesses that occupy property with a rateable value of £12,000 or less will pay no business rates.

Currently, this 100% relief is available if you’re a business that occupies a property (e.g. a shop or office) with a value of £6,000 or less.

There will be a tapered rate of relief on properties worth up to £15,000. This means that 600,000 businesses will pay no rates.

Capital Gains Tax rates will be cut from 6 April 2016, but residential property will still be taxed at current rates

Capital Gains Tax is a tax on the gain you make when you sell something (an ‘asset’) that has gone up in value. It is paid at a basic or higher rate depending on the rate of Income Tax you pay.

From April 2016, the higher rate of Capital Gains Tax will be cut from 28% to 20% and the basic rate from 18% to 10%.

There will be an additional 8 percentage point surcharge to be paid on residential property and carried interest (the share of profits or gains that is paid to asset managers).

Capital Gains Tax on residential property does not apply to your main home, only to additional properties (for example a flat that you let out).

Employers will pay National Insurance on pay-offs above £30,000 from April 2018

From April 2018 employers will now need to pay National Insurance contributions on pay-offs (for example, termination payments) above £30,000 where Income Tax is also due.

For people who lose their job, payments up to £30,000 will remain tax-free and they will not need to pay National Insurance on any of the payment.

Corporation Tax will be cut again to 17% in 2020

The main rate of Corporation Tax has already been cut from 28% in 2010 to 20%, the lowest in the G20. It will now be cut again to 17% in 2020, benefitting over 1 million businesses.

Class 2 National Insurance contributions (NICs) for self-employed people will be scrapped from April 2018

Currently, self-employed people have to pay Class 2 NICs at £2.80 per week if they make a profit of £5,965 or over per year. They also pay Class 4 NICs if their profits are over £8,060 per year.

From April 2018, they will only need to pay one type of National Insurance on their profits, Class 4 NICs.

Paying Class 2 NICs currently enables self-employed people to build entitlement to the State Pension and other contributory benefits.

After April 2018, Class 4 NICs will also be reformed so self-employed people can continue to build benefit entitlement.

The government expects every business to keep its accounting records in a digital form.

This key requirement will under-pin Making Tax Digital (MTD), as was made clear in the MTD for business event held on 3 March. What’s more “digital form” doesn’t mean an Excel spreadsheet. Each business and landlord will have to use some form of accounting software which has a capability to communicate with HMRC’s systems. We expect further details on this software requirement to be included in one of the five consultation documents on MTD to be released shortly after the Budget.

However, moving to a commercial software package will mean extra costs and data transfer problems for many businesses who have created their own bespoke accounting software, or who rely on Excel spreadsheets. Della Hudson of Hudson Accountants agreed that new businesses can keep adequate records on a simple spreadsheet. She said: “We run basic bookkeeping workshops based on Excel for about 40 businesses per year.”

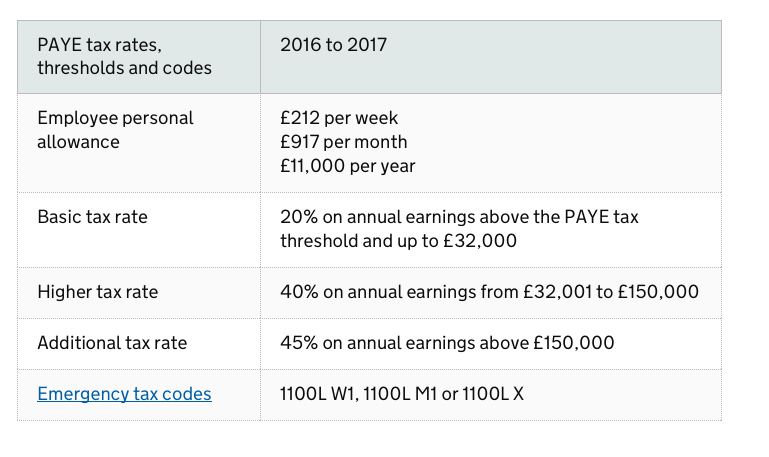

The amount of Income Tax you deduct from your employees depends on their tax code and how much of their taxable income is above their Personal Allowance.

For the tax year 2016 to 2017, the Income Tax information below applies to both Scotland and the rest of the UK (England, Wales and Northern Ireland).

The figures quoted below apply between 6 April 2016 and 5 April 2017.

Xero is beautiful software that handles all of your business accounting functions from bank reconciliation and financial reporting to inventory tracking and payroll.

Xero for WooCommerce gives you the ability to set up automatic creation of invoices in Xero for ecommerce sales. After the module is installed and configured, each order placed in your WooCommerce store is securely sent to your Xero account to keep records up to date.

All product, shipping, discount, and tax data is sent to Xero. When payments are made, they are applied to the appropriate invoice to keep everything in balance.

email us today for help creating a website with Xero integrated

If you leases a car, you can usually only claim 50% of the VAT. Although you may be able to reclaim all of the VAT if the car is used only * for business and is not available for private use, see some examples below.

- will be used exclusively for the purposes of the business and is not available for any private use; or

- is intended to be used primarily as a taxi, driving-instruction car or self-drive, that is daily rental, car.

* Exclusively for business use

To qualify as being available exclusively for business use, a car must be used only for business journeys and not ‘made available’ for the private use of anyone, including employees.

The phrase ‘made available’ has been given a very broad meaning by HMRC, and so a car is available for private use if there is nothing preventing its private use by anyone, including employees, which means that if HMRC were to look into these transactions then if 100% of the VAT has been reclaimed and they feel that your client does not meet the criteria the VAT will need to be repaid.