Automatic payroll updates in your general ledger means all business finances in one place. Your business saves time andincreases productivity by doing away with manual data entry.

Increase employee engagement

Reduce double handling. Allow employees to apply for time off with a clear view of their pay history. And let employees approve leave for others without seeing the rest of your financials.

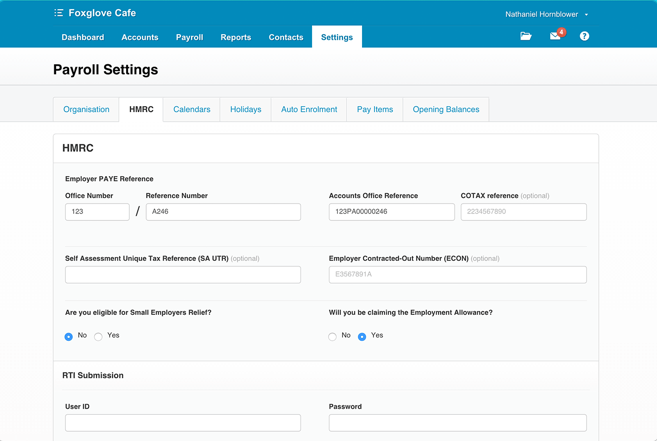

Submit Real Time Information (RTI)

Make RTI submissions to HMRC easy. All it takes is a couple of clicks within Xero to ensure that your submissions are timely and correct.

Get flexible payroll for any business

Payroll in Xero has unlimited and flexible earnings, deductions, benefits and reimbursement types. Pay your employees using a range of pay frequencies, with multiple pay calendars allowed.

Create P45s and P60s for employees

Close an employee’s payroll record and create their P45 in just a few steps. At the end of the tax year it’s easy to process all your P60s at once using Payroll in Xero.

Deploy time off management

Track and report employee absences with payroll, including manager approval and auto-accrual. It means you increase your productivity by taking data duplication out of your process.