One of the most frequent questions asked by landlords is whether to buy investment property in their own name or through a ltd company.

It’s a great question and there is no simple answer.

It will depend on a number of factors surrounding the particular circumstance of the buyer such as how long the properties will be owned for, when to extract the cash, how much income the investor wants to extract and what other income sources they may have.

Lots of our Progressive delegates have found these Property Investment Tax Tips useful.

Before we go into any details about should it be a Property Investment company or individual lets set the scene. The majority of investors buy property in their personal names because there are less hurdles to jump over.

The vast majority of buy to let lenders will only lend to people who buy properties in their own name and therefore for those starting out this will be the determining factor that will make the decision easy.

Buy to Let mortgages are designed for people who are earlier in their investing journey and can be simpler to obtain. Commercial Lenders/mortgages are more flexible in this regard, usually being available for property investment through ltd company, LLPs, Personal names or even trusts.

You see when you buy property through ltd company, this is seen to have a separate legal status to individuals.

So when you search on Land Registry, the company’s name will appear as the owner rather that the individual’s.

This can be useful if you want to keep your details private and might be useful in protecting your personal credit status against utility providers who register late payments for bills you haven’t received and other civil claims.

But owning in a Ltd company/LLP will mean you have to publish publicly available financial accounts on your portfolio, which whilst not detailed when small will become quite clear as the size of your company/portfolio grows and the reporting requirements increase.

Personal Guarantee…

Mortgage lenders will often ask for a personal guarantee (some probably wont such as Lloyds) if you own the property investment through ltd company meaning that whilst you protect yourself personally from other creditors you are personally liable for all debts to the mortgage lender anyway so this does not change by having a Ltd company.

If you want the benefits of limited liability but want to use the personal tax regime try using LLPs, this is what i do as I feel it gives the best of everything.

You only need one shareholder to purchase through a ltd company so you can hold the only share and still be the sole owner. And if you’re a shareholder you are of course entitled to the share of the profit and this will be paid out in dividends.

You don’t need to own a vast property portfolio to benefit from a corporate structure, one property is enough.

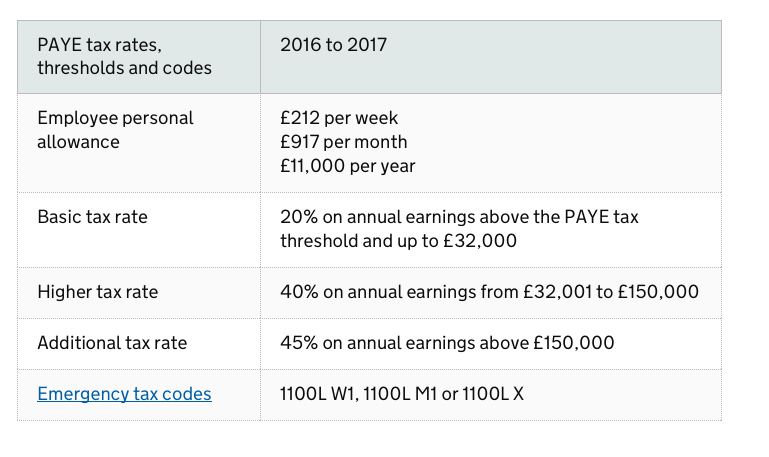

When you have the property investment through ltd company you pay corporation tax which is likely to be around 20% of the profit generated (but not drawn out) of the business.

Should you leave all of the profits within the company this the only tax you will be liable to pay on profits. For those who don’t want to draw any (or much) of the funds personally to create a personal income this can be very useful and offers a definite advantage over owning property personally.

Re-Investing…

If you are like me and like to reinvest profits to create bigger profits the compounding effect of only paying 20% tax over time is huge. With some paying 40% tax on their rental income profits you could potentially generate a yearly tax saving of 20% which would snowball into big numbers if consistently reinvested over many years.

When owned personally, any property income would be taxed in its entirety every tax year giving no ability to defer.

Personal Use…

But the story changes if you want to draw these profits out as an income for personal use. If all the profits were drawn out in the form of dividends on a yearly basis you would end up paying around the same level of tax as if you owned the properties personally because whilst Limited Companies will pay Corporation Tax at 20%, and basic rate (20%) income tax payers wont pay tax on the dividends they receive, higher rate (40%) income tax payers then pay tax on dividends meaning there is little difference between owning personally or doing the property investment through ltd company if you draw all the profits in dividends.

“Compound interest really is the 7th wonder of the world, and I love it!”

For those who only want to draw a portion (rather than all) of their profits out of their Ltd company the snowball effect of the tax saved and reinvested could be huge in years to come.

Disposing the Asset…

When you come to sell a property rather than paying 18% (basic rate tax payer) or 28% (higher rate taxpayer) capital gains tax for properties held in your own name the ltd company would pay 20% corporation tax and you would then be subject to the same tax on dividends outlined above for higher rate taxpayers.

This coupled with the fact that you get no personal capital gains tax allowance (The first £11,100 each so £22,200 if you own it with your wife/husband/someone else of gains where you pay no capital gains tax) often means Capital gains is tax lower for properties owned in your own name rather than the tax regime afforded to Ltd Companies.

So if you are likely to sell a property every few years you are better to own it personally to reduce your capital gains tax bill.

Should this become too frequent however (say more than 1 a year) HMRC will claim you are property trading and charge you income tax anyway. An important consideration when deciding whether to have a Property Investment company or individual.

Remortgaging your buy to let investment

Another major benefit of owing properties personally and not doing the property investment through ltd company is as follows: Remortgage money is tax free.

Should you remortgage a property in your own name the cash would come to you and could be used for any purpose, no tax would be due until you sold the propert(ies).

Lets say you purchased 10 houses for £100k each or £1m. In 30 years they are worth £4M in total, you remortgage them over the years and take out £3M in remortgage cash – as this is borrowed money there is no tax due and these funds can be spent on whatever you want.

When you die it is only the remaining equity which is taxed (£1M in this example as long as the other funds have been gifted to others such as children or spent) meaning you have avoided paying tax on the £3M you released over the years, an amazing strategy – obviously this is an extreme example and you might want to only follow it on some properties as you will have a big tax bill should you have to sell your properties in your lifetime!

Should you own these properties in a Ltd company you would have to extract the remortgage money through Salary (if your company didn’t have enough profits to support dividends at this level, as is likely) which would mean huge income tax and national insurance, so it wouldn’t work. So a definite score to owning personally.

Capital Allowances…

Rob and I also like to claim capital allowances which are allowances on plant and machinery items on purchases of commercial buildings. Typically you get about 20% of the purchase price of such properties offset against your personal income (from any source) up to £50k.

So if you purchased a property for £300k you might be able to claim £60k in allowances, for someone that earns £100k a year as a salary you could use sideways loss relief up to £50k this would reduce their personal income by around £50k meaning that they pay their income tax on £50k rather than £100k which would usually be paid at 40%.

Should put the property investment through ltd company you will only be offsetting 20% corporation tax (and couldn’t offset it against tax on dividends) which is a definite disadvantage,

What’s the way to go?

So to conclude, which is better, a Property Investment company or individual? I think you can see that it depends who you are and what you want to do.

You may like us have a mixture of owning properties personally, within Ltd companies and LLPs and your decision will affect the amount of Property investment Tax you may massively so its worth spending time on this. What I do know is that It is rarely worth transferring properties out of your name into Ltd companies/LLP or visa versa as you will be liable for stamp duty and capital gains tax based on the gain you have enjoyed at the time of the transfer.

If you want to change your strategy just do it for future purchases